In the Midst of Inflationary Collapse, Yahoo and Fortune Celebrate the Same Economic Madness That Caused the Problem

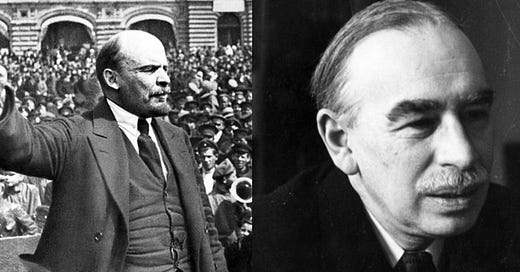

And they covertly compliment a mass murderer...

Only ignorance of economics, or an intent to deceive, can account for anyone telling you that government interference with free trade is morally acceptable or beneficial.

If you’d like a perfect contemporary example of this truism, try reading a new “Fortune” article by Colin Lodewick and Nick Lichtenberg — even its headline screams economic ignorance or…

Keep reading with a 7-day free trial

Subscribe to Gardner Goldsmith to keep reading this post and get 7 days of free access to the full post archives.